Condominium Insurance Insights

What is condominium insurance?

As a condominium unit owner, you have title to your own unit, as well as a share in common (and or managed) property such as the lobby, hallways, parking garage and other amenities. A bare land condominium may have fewer common areas, typically just streets or roadways but can also include managed property such as the roof, exterior siding, and sewer lines. It is important to note that the definition of what is “owned” by the unit owner depends on the condominium and typically outlined in the bylaws and on the condominium plan.

If you have purchased a condominium unit, the insurance policy you bought might have seemed similar to something like the coverage you might have gotten with a Tenant insurance policy (i.e. Personal contents and liability).

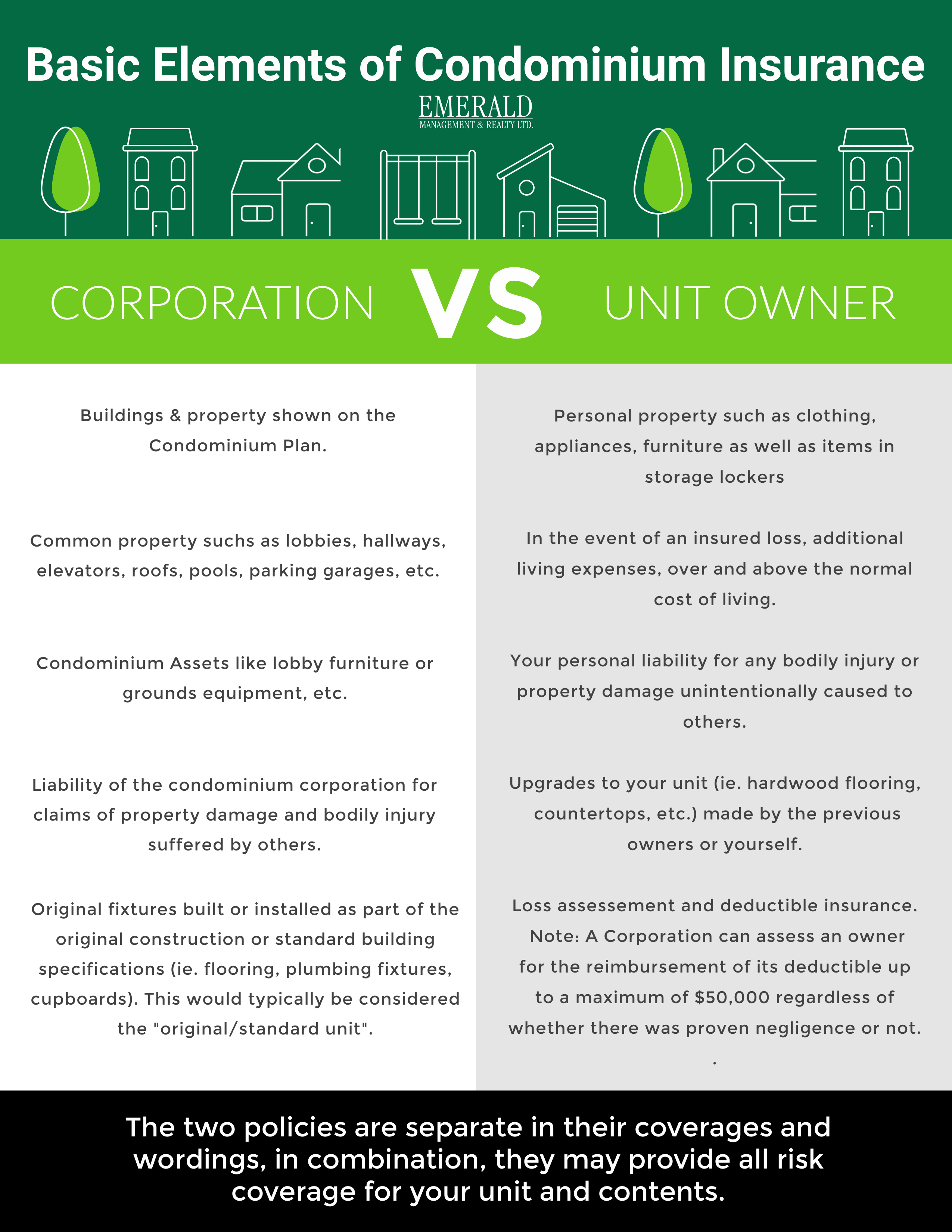

When it comes to buying condominium owner coverage, it is important to note that coverage is available under two separate and distinct policies: one for the corporation, and one for the unit owner.

Having two insurance policies can be confusing but while the two policies are separate in their coverages and wordings, in combination, they may provide all risk coverage for your unit and contents.

Detailed information about what is covered is specific to each Corporation and typically defined in the Condominium Bylaws. Your Insurance Broker is the expert with respect to your personal coverage. Call them and discuss your concerns to make sure you get the best possible coverage for your protection.

Tip: Provide your condominium corporation’s insurance policy plus your bylaws to your insurance broker. This helps to make sure you have the proper coverage in place.

Tip: Provide your condominium corporation’s insurance policy plus your bylaws to your insurance broker. This helps to make sure you have the proper coverage in place.

Why do I have to buy condominium unit owners insurance?

The Condominium Property Act specifies that condominium corporations are responsible to insure Corporation owned property, and unit owners are responsible to insure their Units and personal property.

In addition to the Corporation’s policy, it is especially important that you also have a Condominium Unit Owners Policy in place for your protection. Remember: The Corporation’s policy does not cover your personal contents, liability or in many cases, improvements to your unit.

How does this insurance benefit me?

Like homeowner’s insurance, a condominium owner’s policy would cover the insured’s personal property and contents, third party liability, and additional living expenses in the event something happens (like a fire or burst water pipe) that prevents them from staying in their home.

In addition, condominium owner insurance also protects the unit’s improvements and betterments, deductible costs, the unit itself or a loss assessment on the building should the corporation have no insurance or have inadequate insurance for which that the owner’s policy would normally cover.

What is Loss Assessment Coverage?

Loss assessment coverage is unique to condominium insurance. Since unit owners share responsibility for common property or elements, this coverage pays your share (up to a stated limit) for a major property or liability loss on common property.

Important insurance changes impacting deductibles and loss assessment coverage

Effective January 1, 2020, the Condominium Corporation has the power to seek recovery from any Owner where damage has originated from the owner’s unit for the deductible up to a maximum of $50,000 on an insurance claim. This “absolute liability” means that regardless of whether there was proven negligence or not, the Corporation can hold the Owner liable. This clause is part of the Condominium Regulations (Section 62.4).

For example:

If the Corporation’s deductible is $15,000, and there is damage that originates from an owner’s unit, in the amount of $20,000, the Condominium Board has the authority to recover $15,000 from the Owner.

Alternatively, if the Board has a $15,000 deductible, but the damages are only $5,000, the Board only has the authority to recover $5,000.

In the same regard, if the Corporation has a deductible that is over $50,000 and damages exceed the deductible, the maximum the Board can recover is $50,000.

What steps can condominium unit owners take to protect themselves and have the proper condominium unit insurance policy?

- Ask your Condominium Board or Property Manager for a copy of the Corporation’s Insurance Certificate

- Contact a personal Insurance Broker and provide them with a copy of the corporation’s certificate along with a copy of your condominium bylaws

- Confirm that their Unit Owner policy has deductible or loss assessment coverage and how much they are covered for in the event they are obligated to pay.

- Confirm the amount of the deductible for the Condominium Corporation’s insurance policy(on the corporation’s insurance.

- Confirm that the value of deductible coverage in their Unit Owner policy is at least equivalent to the value of the Condominium Corporation’s deductible; and

- Pay attention to any notice from the Corporation which changes or increases the amount of the Corporation’s deductible and increase their coverage (to a maximum of $50,000), as required.

- Get written confirmation from your insurance provider that they have deductible coverage for the Corporation’s deductible.

- Keep a copy of your policy with your important documents and review coverages annually on receipt of your corporation’s insurance renewal for any changes or coverage updates.

Note: Deductible coverage is different from special assessment coverage.

With close to 50 years of property management experience, Emerald Management & Realty Ltd. is a licensed property management brokerage and trusted to respond with experience and responsive systems. Emerald Management & Realty Ltd. offers a wide range of condominium property management services. Our primary goal is to offer peace of mind and help condominium boards realize the long-term profitability, a solid governance approach and assist to minimize risk. Contact us today to find out more about how our team at Emerald Management & Realty Ltd. can help by calling 403-237-8600.

« Return to Blog